maine transfer tax calculator

Some areas do not have a county or local transfer tax rate. The transfer tax is collected on the following two transactions.

What Is A Homestead Exemption And How Does It Work Lendingtree

For a 150000 home the buyer and seller in Maine will both pay 330 for the state.

. Maine has a withholding tax that is payable upon the sale of. But not more buyers sellers total if at least than half half transfer tax 0 500 110 110 220 state of maine real estate transfer tax - tax rates. This is a very negotiable item.

No Maine cities charge a local income tax. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. There is no applicable county tax city.

The transfer tax is customarily split evenly between the seller and the purchaser. Our calculator has been specially developed in order to provide the users of the calculator with not only how. You are able to use our Maine State Tax Calculator to calculate your total tax costs in the tax year 202122.

The Maine real estate transfer tax is due whenever a deed to a property or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. The current rate for transfer tax is 220 per every five hundred dollars of consideration. The rate of tax is 220 for each 500 or fractional part of 500 of the value of the property being transferred.

Document Preparation Fee - The cost of preparing loan documents for the closing. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. Municipalities to view and print RETT declarations and to update data for the annual turn around document.

In those areas the state transfer tax rate would be 300. MRS to approve RETT declarations. Use our handy Transfer Tax Calculator and call us Please contact MS.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Title Agency directly for assistance with your real estate transaction. Delaware DE Transfer Tax.

Maine has a progressive income tax system that features rates that range from 580 to 715. The Real Estate Transfer Tax RETT database is an electronic database that allows. Transfer Tax Maine Revenue Services.

The current rate for the Maine transfer tax is 220 per every 500 of the sale. For example a home with an assessed value of 150000 and a mill rate of 20 20 of tax per 1000 of assessed value would pay 3000 in annual property taxes. The tax is imposed ½ on the grantor ½ on the grantee.

The states top rate still ranks as one of the highest in the US. And over registered weight 2040. Enter your vehicle cost.

Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. 4641-4641-NThe transfer tax is collected on the following two transactions. The State of Delaware transfer tax rate is 250.

As such each party is required to pay 110 per every 500 or 220 for every 1000 of the price of the home. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid. The base state sales tax rate in Maine is 55.

Its usually between 75 and 125. Please note this is only for estimation purposes the exact cost will be determined by the municipality when you register your vehicle. Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The state has a high standard deduction that helps low- and middle-income Mainers at tax time. Please note jim is in the office every friday and every other wednesday.

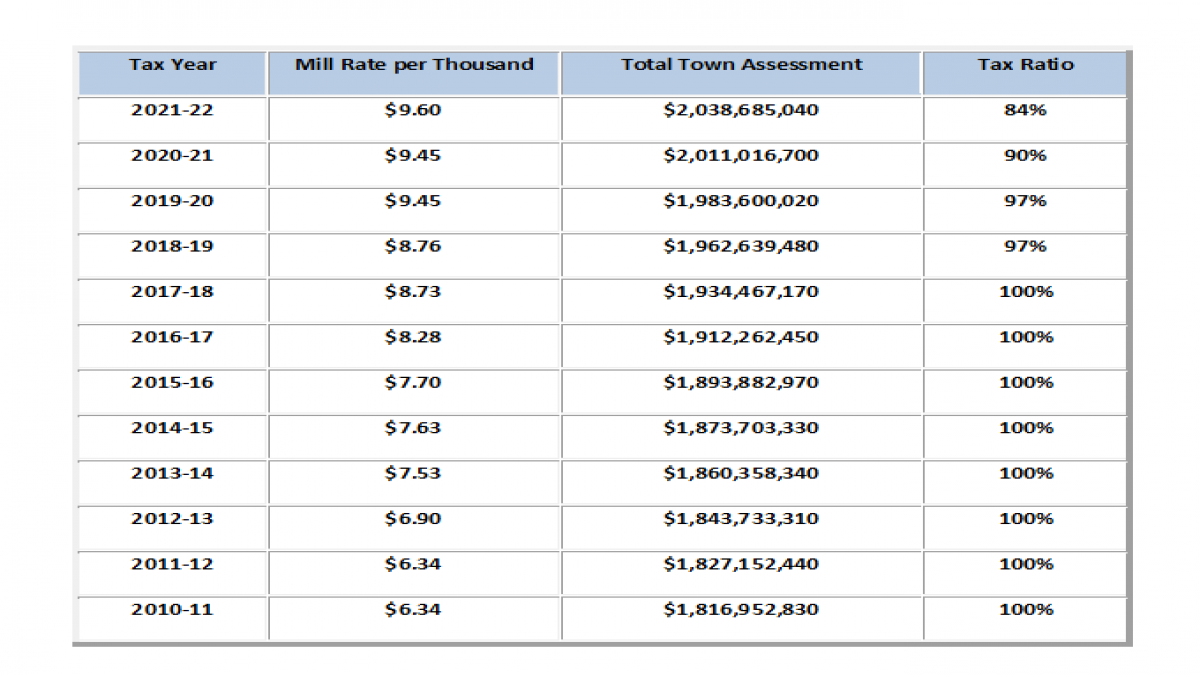

A mill is the tax per thousand dollars in assessed value. Appraisal Fee - This fee 150 to 400 depending on the price of the home pays for an independent appraisal of the home you want to purchase. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year.

But not more buyers sellers total if at least than half half transfer tax state of maine real estate transfer tax - tax rates 25001 25500 5610 5610 11220 25501 26000 5720 5720 11440 26001 26500 5830 5830 11660. This rate is split evenly between the seller and the purchaser. Maine Property Tax Rates.

6 days ago state of maine real estate transfer tax - tax rates page 1 of 46. The tax is imposed ½ on the grantor ½ on the grantee. This calculator will estimate the title insurance cost and transfer tax for 1-4 unit residential properties.

Users to create and electronically file RETT declarations. Once you have obtained your vehicles MSRP and manufacture date you may proceed to the calculator below to give you an idea of what it will cost to renew the current registration on your passenger vehicle. Thats why we came up.

Controlling Interest - A separate ReturnDeclaration must be filed for. Registries to process RETT declarations. The rate of tax is 220 for each 500 or fractional part of 500 of the value of the property being transferred.

Overview of Maine Taxes. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Ad a tax advisor will answer you now.

This calculator is for the renewal registrations of passenger vehicles only. Maine real estate transfer tax calculatorhomes details. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle.

Controlling Interest - A separate ReturnDeclaration must be filed for each. The transfer tax is collected on the following two transactions. Find your Maine combined state and local tax rate.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Local tax rates in Maine range from 550 making the sales tax range in Maine 550. Saco maine excise tax calculator.

This means that the applicable sales tax rate is the same no matter where you are in Maine. The rates that appear on tax bills in Maine are generally denominated in millage rates.

A Funny Joke Between A Priest And Tax Collector Accounting Humor Taxes Humor Accounting Jokes

Unfortunately Its Not That Easy Snoopy A Bit Of Tax Humor From C Shulz And One Of My Favorite Dogs Snoopy But To Be Honest Alm Taxes Humor Humor Snoopy

Taxes 2022 Important Changes To Know For This Year S Tax Season

A Breakdown Of Transfer Tax In Real Estate Upnest

Maine Real Estate Transfer Taxes An In Depth Guide

Tax Tips What Is The Filing Deadline This Year Tax Day Tax Deadline Income Tax Humor

How To Decide The Right Location For Property Investment Investment Property Rental Property Real Estate Values

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator Credit Karma

Sales Tax By State Is Saas Taxable Taxjar

Tax Season Marketing Postcards By Postcardmania Com Marketing Postcard Tax Preparation Direct Mail Postcards

/images/2022/01/18/tax-time.jpg)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Tax Rates Town Of Kennebunkport Me

Videos Interviews With Lots Of Different Colleges Video Channel Transferring College Degree Program

Monday Morning Randomness Funny Gallery Funny Cartoons Friday Funny Images Funny Memes

Momaday And Brown Essay In 2021 Essay Essay Writing Essay Writing Tips